Alright, let’s talk about figuring out your net worth. It’s not as scary as it sounds, trust me.

First off, why even bother? Well, knowing your net worth is like taking a snapshot of your financial health. It tells you where you stand right now and helps you track progress over time. Think of it as a financial check-up.

Okay, so where do you start? I’ll break it down step-by-step, just like I did when I first started tracking mine.

Step 1: Gather All Your Financial Info

This is probably the most tedious part, but you gotta do it. You’re gonna need to collect statements for pretty much everything you own and owe. I’m talking:

- Bank accounts (checking, savings)

- Investment accounts (brokerage, retirement accounts)

- Credit card statements

- Loan statements (mortgage, student loans, car loans)

- Pay stubs (to get an idea of your regular income)

I personally use a spreadsheet to keep everything organized, but you can use whatever works for you. A notebook, a dedicated app – whatever floats your boat.

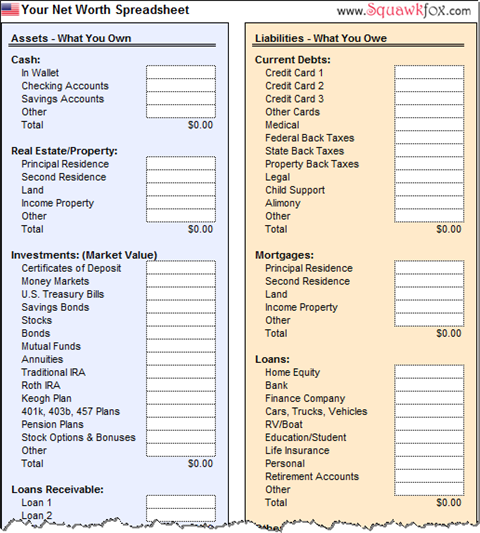

Step 2: List Your Assets

Assets are basically everything you own that has value. This includes:

- Cash (in your bank accounts, or even just stashed around the house)

- Investments (stocks, bonds, mutual funds, ETFs, cryptocurrency – whatever you got)

- Real estate (your house, rental properties)

- Vehicles (cars, motorcycles, boats)

- Personal property (jewelry, collectibles, furniture – anything of significant value)

Important: When listing personal property, be realistic about the value. That old stamp collection might seem valuable, but unless you get it appraised, it’s probably not worth as much as you think. I made this mistake early on and inflated my net worth way too much!

Step 3: List Your Liabilities

Liabilities are what you owe. These include:

- Credit card debt

- Student loans

- Car loans

- Mortgage

- Personal loans

- Any other outstanding debt

Make sure you’re listing the current balance of each liability, not just the original loan amount.

Step 4: Calculate Your Net Worth

This is the easy part! Just subtract your total liabilities from your total assets:

Net Worth = Total Assets – Total Liabilities

If the number is positive, congrats! You have a positive net worth. If it’s negative, don’t panic. It just means you owe more than you own. It’s a starting point, and you can work to improve it.

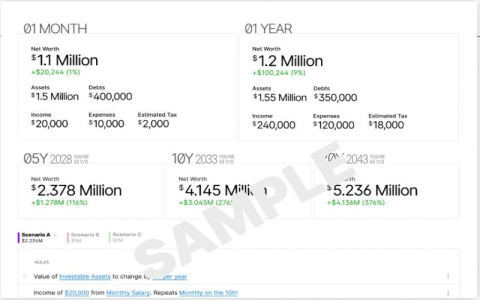

Step 5: Track Your Progress

This is where the magic happens. Calculate your net worth regularly – I do it monthly. Seeing your net worth increase (or decrease) over time is a great motivator to stay on track with your financial goals. You can see where you are making progress and where you might need to adjust your strategy.

A couple of tips I learned along the way:

- Be consistent. The more regularly you track, the more accurate your picture of your financial health will be.

- Don’t compare yourself to others. Everyone’s financial situation is different. Focus on your own progress and goals.

- Don’t be afraid to ask for help. If you’re struggling with debt or have questions about investing, talk to a financial advisor. They can provide personalized guidance.

That’s pretty much it! Figuring out your net worth isn’t rocket science. It just takes a little bit of time and effort. But trust me, it’s worth it. Knowing where you stand financially is the first step to taking control of your money and achieving your financial goals.